Mizuho Securities presence

In a drastically changing world where social structures and the economic landscape are in constant flux, we provide sophisticated financial services in collaboration with group companies to address client concerns and business issues.

Our strengths

- Client-driven/client-centric consulting and services

- A professional organization possessing sophisticated expertise and knowledge

- Leveraging the group's collective strength to deliver optimal solutions

- The largest client base in Japan coupled with an industry-leading network of offices

- A global network and significant presence in the growing US market

Retail

Asset inflows

AUM

Wholesale

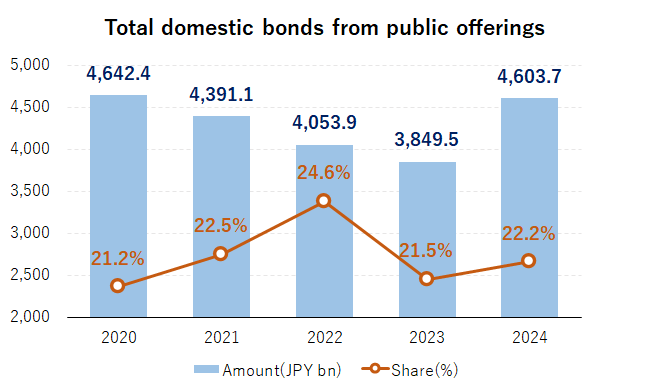

Bond Underwriting

Domestic Bonds from Public Offerings

Total Domestic Bonds from Public Offerings (Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | Amount (JPY bn) | Share(%) |

| 1 | Mizuho Securities | 4,603.7 | 22.2 |

| 2 | Daiwa Securities | 4,451.0 | 21.5 |

| 3 | SMBC Nikko Securities | 4,262.1 | 20.5 |

| 4 | Nomura Securities | 3,253.5 | 15.7 |

| 5 | Mitsubishi UFJ Morgan Stanley Securities | 2,776.7 | 13.4 |

Based on underwriting amount and pricing date basis. Includes samurai bonds, municipal bonds (underwriting only) ,preferred securities but excludes securitization and ST.

Source: Prepared by Mizuho Securities based on data from Capital Eye

SDGs Bonds

Japan SDGs Bonds (Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | Amount (JPY bn) | Share(%) |

| 1 | Mizuho Securities | 1,102.6 | 24.1 |

| 2 | Daiwa Securities | 1,080.6 | 23.7 |

| 3 | SMBC Nikko Securities | 902.4 | 19.8 |

| 4 | Nomura Securities | 847.9 | 18.6 |

| 5 | Mitsubishi UFJ Morgan Stanley Securities | 470.255 | 10.3 |

Based on underwriting amount and pricing date basis. Excludes own company bonds, securitization and ST.

Source: Prepared by Mizuho Securities based on data from Capital Eye

Subordinated bonds

Subordinated bonds(Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | Amount (JPY bn) | Share(%) |

| 1 | Mizuho Securities | 327.2 | 23.0 |

| 2 | SMBC Nikko Securities | 324.5 | 22.8 |

| 3 | Mitsubishi UFJ Morgan Stanley Securities | 271.4 | 19.1 |

| 4 | Daiwa Securities | 252.3 | 17.7 |

| 5 | Nomura Securities | 242 | 17.0 |

Based on underwriting amount and pricing date basis. Excludes own company bonds and securitization.

Source: Prepared by Mizuho Securities based on data from Capital Eye

IG USD-denominated Corporate Bonds (Americas)

IG USD-denominated Corporate Bonds (Americas) (Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | Amount (USD mn) | Share(%) |

| 1 | JPMorgan | 65,474 | 10.1 |

| 2 | BofA Securities | 60,780 | 9.4 |

| 3 | Citi | 53,630 | 8.3 |

| 4 | Wells Fargo | 51,061 | 7.9 |

| 5 | Goldman Sachs | 36,028 | 5.5 |

| 6 | Mizuho Financial Group | 34,083 | 5.2 |

Bookrunner basis, bonds issued by investment grade corporations in the Americas (issue amount USD 250M or more)

Source: Prepared by Mizuho Securities based on Dealogic data

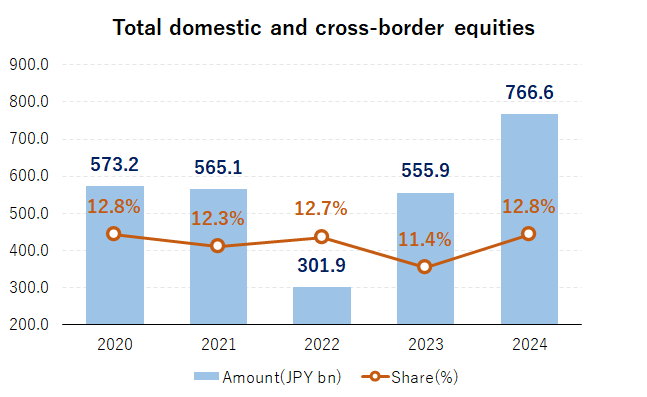

Equity Underwriting

Total Domestic and Cross–border Equities (Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | Amount (JPY bn) | Share(%) |

| 1 | Nomura Holdings | 1,686.7 | 28.2 |

| 2 | SMBC Nikko Securities | 906.4 | 15.1 |

| 3 | Mizuho Financial Group | 766.6 | 12.8 |

| 4 | Mitsubishi UFJ Morgan Stanley Securities | 718.2 | 12.0 |

| 5 | Daiwa Securities Group Inc. | 646.7 | 10.8 |

Based on bookrunner and pricing date basis.

Deals including initial public offerings, public offerings, convertible bonds and REITs.

Source: Prepared by Mizuho Securities based on data from LSEG

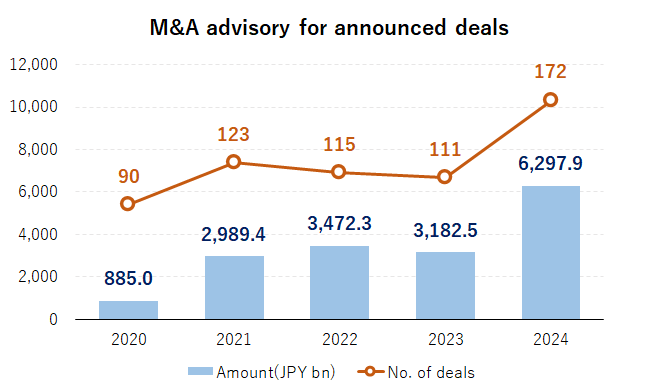

M&A Advisory

M&A Advisory for Announced Deals (Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | No. of deals | Amount (JPY bn) |

| 1 | Mitsubishi UFJ Morgan Stanley Securities | 88 | 18,809.9 |

| 2 | Nomura Securities | 129 | 14,878.6 |

| 3 | Goldman Sachs | 26 | 13,235.6 |

| 4 | Mizuho Financial Group | 172 | 6,297.9 |

| 5 | JP Morgan | 22 | 5,429.4 |

| 6 | Daiwa Securities Group Inc. | 88 | 4,273.6 |

| 7 | Sumitomo Mitsui Financial Group | 117 | 3,168.4 |

Based on deal amounts. Includes any Japanese related deals but excludes real estate deals

Source: Prepared by Mizuho Securities based on data from LSEG

Structured Finance

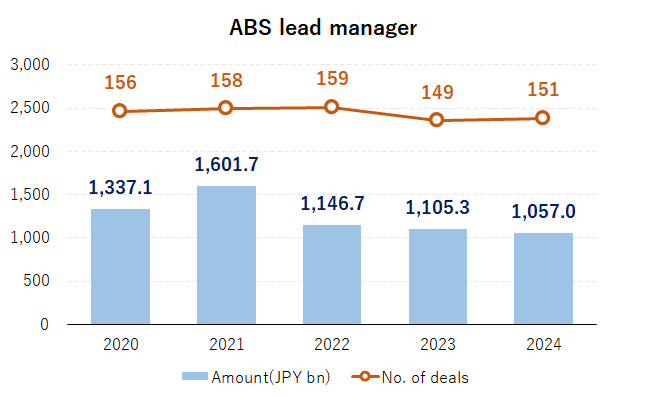

ABS Lead Manager (Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | No. of deals | Amount (JPY bn) |

| 1 | Mizuho Financial Group | 151 | 1,057.0 |

| 2 | Sumitomo Mitsui Trust Holdings | 29 | 555.2 |

| 3 | Mitsubishi UFJ Financial Group | 35 | 426.7 |

| 4 | Sumitomo Mitsui Financial Group | 28 | 288.5 |

| 5 | Daiwa Securities Group Inc. | 11 | 202.2 |

Based on deal amounts and settlement dates

Source: Prepared by Mizuho Securities based on data from LSEG

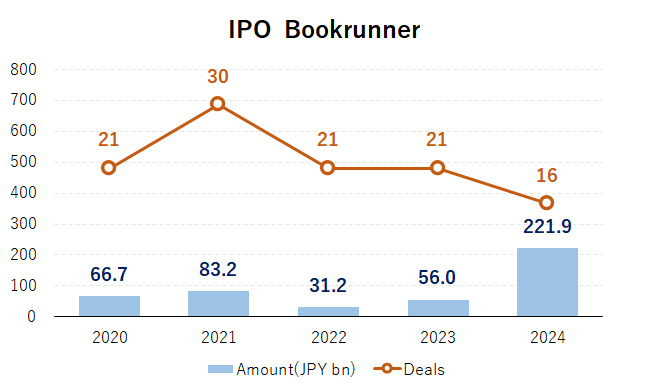

IPO Bookrunner

IPO (Apr. 1, 2024 – Mar. 31, 2025)

| Rank | Company Name | No. of deals | Amount (JPY bn) |

| 1 | Nomura Holdings | 16 | 286.4 |

| 2 | Daiwa Securities Group Inc. | 16 | 239.2 |

| 3 | Mizuho Financial Group | 16 | 221.9 |

| 4 | Morgan Stanley MUFG Securities | 10 | 96.5 |

| 5 | Mitsubishi UFJ Morgan Stanley Securities | 11 | 96.3 |

Based on bookrunner and pricing date basis.

Including initial public offerings excludes REIT and Global Offering

Source: Prepared by Mizuho Securities based on data from LSEG